Unsecured Personal Loans

Power a revenue generating, responsible approach to lending

Grow new revenue streams with fast, flexible lending experiences

Satisfy your customer’s goals immediately with credit solutions that break the cost into affordable repayments.

Powered by the balance sheet of a major UK based bank, leading approval rates and proven credit risk expertise, we offer everything you need to lend responsibly.

Realise your customer's ambitions

Your customers can choose the right loan structure and terms to fit their needs, whether it’s a home renovation, buying a car or any significant life event.

We keep it fast and simple, throughout the application, from the best loan option at a competitive rate, to a fully digital and seamless journey.

Key features

Quick decisions with instant payout

Customers can check their eligibility with pre-approved offers. Loans could be approved and dispersed in minutes.

Real rates from a trusted provider

Our services are fair, personalised and transparent. Your customers know what they’re getting, from a brand they trust.

Frictionless and paperless

Our personal loans solution integrates into your digital journey, ensuring a frictionless experience in your own look and feel.

Extend your reach with aggregators

Seamlessly integrate our offering with relevant aggregator channels in your sector to reach a bigger audience.

Future flexibility

Tailor our personal loans solution to your customers’ needs. Use configurable rates to quickly evolve your position.

Business benefits

Grow new sources of revenue

Increase sales and recognise upfront revenue generated through origination fees.

Evolve your brand’s relevance

Expand your market presence and attract a bigger customer base by widening your range of ancillary services.

Unlock future embedded finance opportunities

Integrate personal loans with our Instant Access Savings, or extend your services with POS Lending as you grow.

Customer benefits

Achieve goals

No need to put those dreams on hold. Your customers can complete that important purchase today.

Increase confidence

Your customers can afford purchases sooner and make decisions more confidently.

Simple and frictionless experience

Our services are fair, personalised and transparent. Your customers know what they’re getting, from a brand they trust.

Latest news

NatWest Boxed and The AA partner to bring savings and loans to millions of customers

The AA will leverage Boxed’s embedded finance platform to offer financial products to millions of AA customers, as well as the wider market.

Making frictionless finance a reality

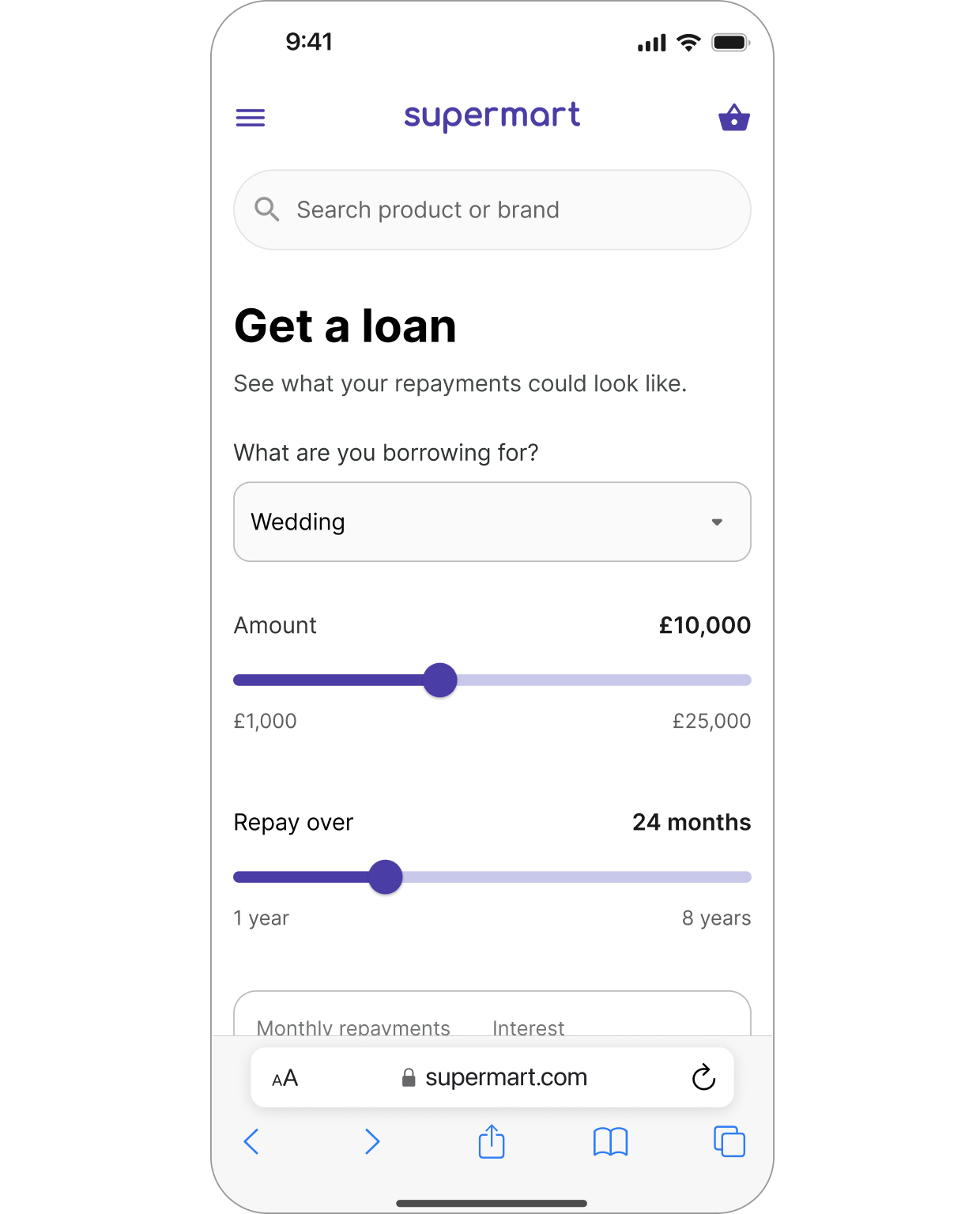

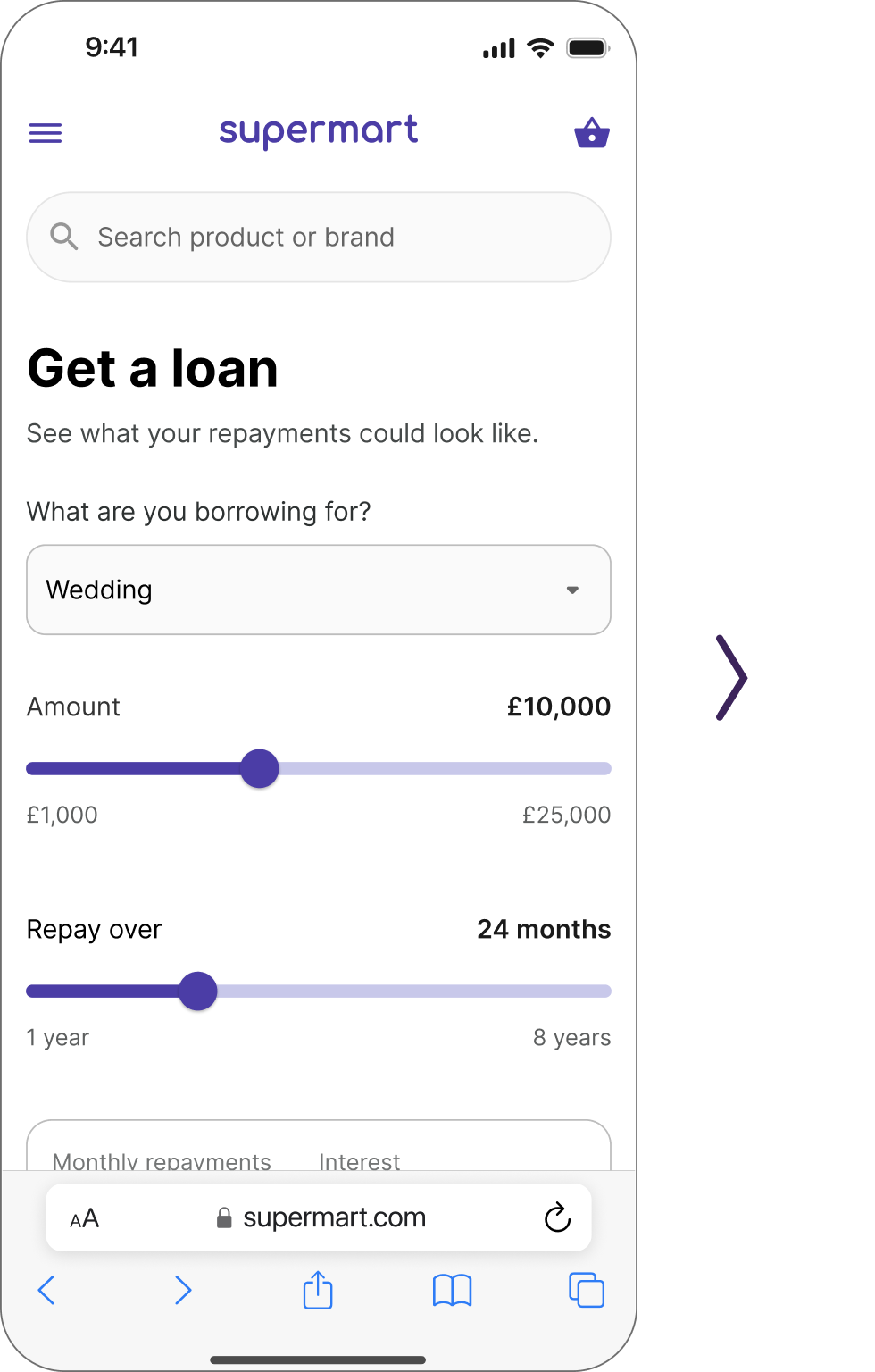

Pre-determine affordability

Customer uses a loan calculator to get an estimate of how much the loan will cost.

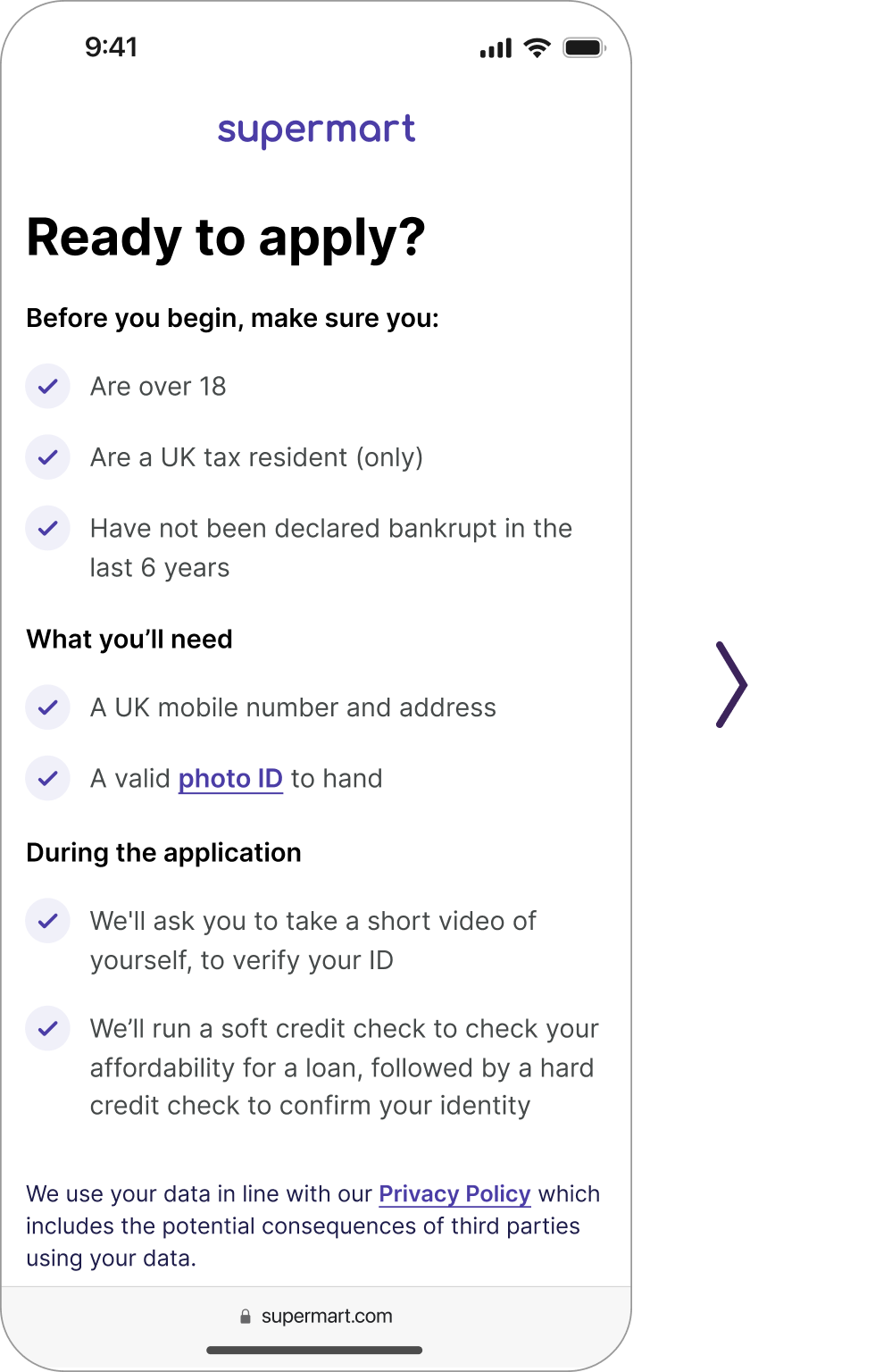

Eligibility criteria

Customer reviews the eligibility criteria before continuing on the application journey.

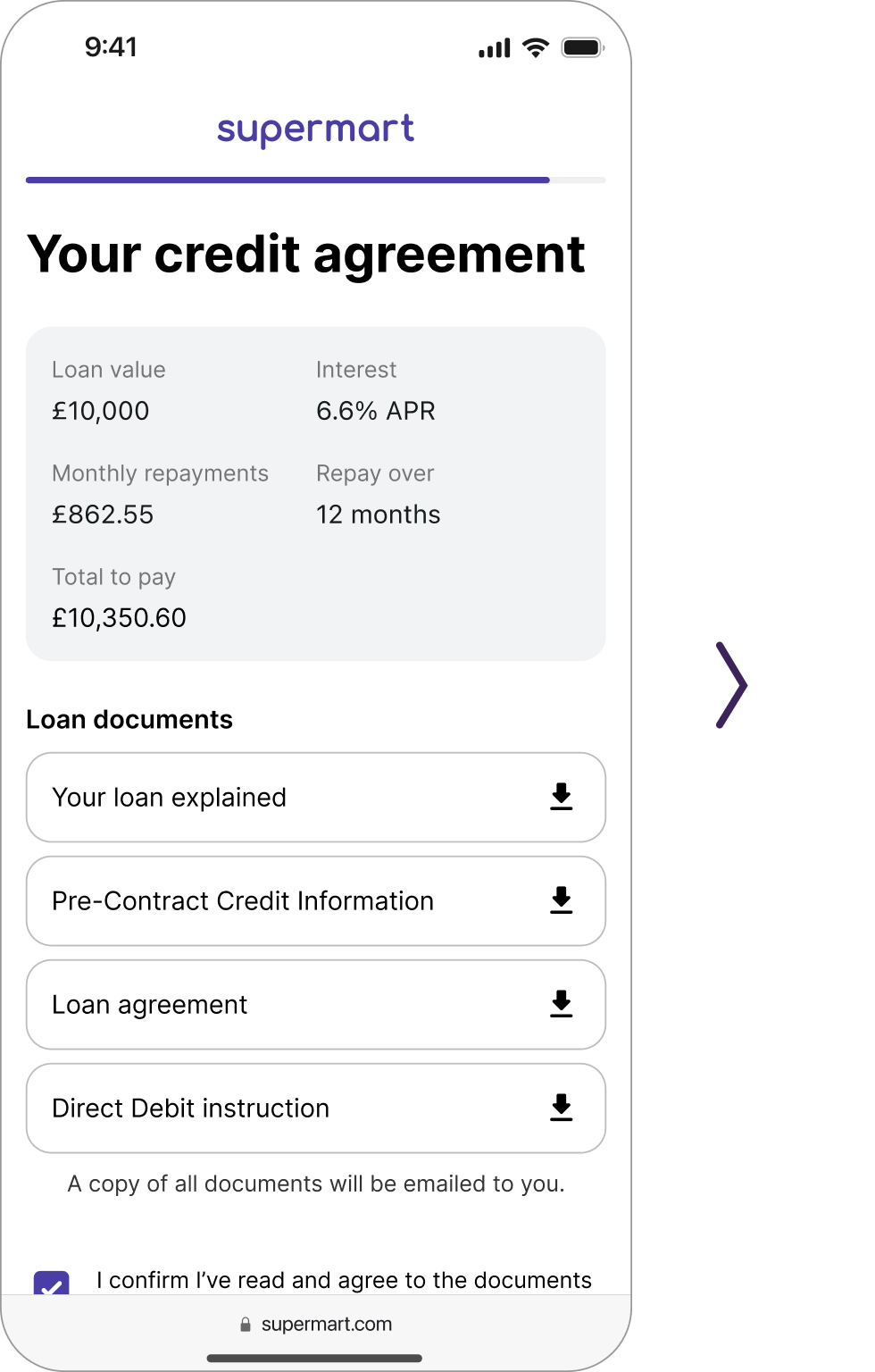

Review terms

Customer reviews documents underlining their credit agreement and confirms that they accept the terms.

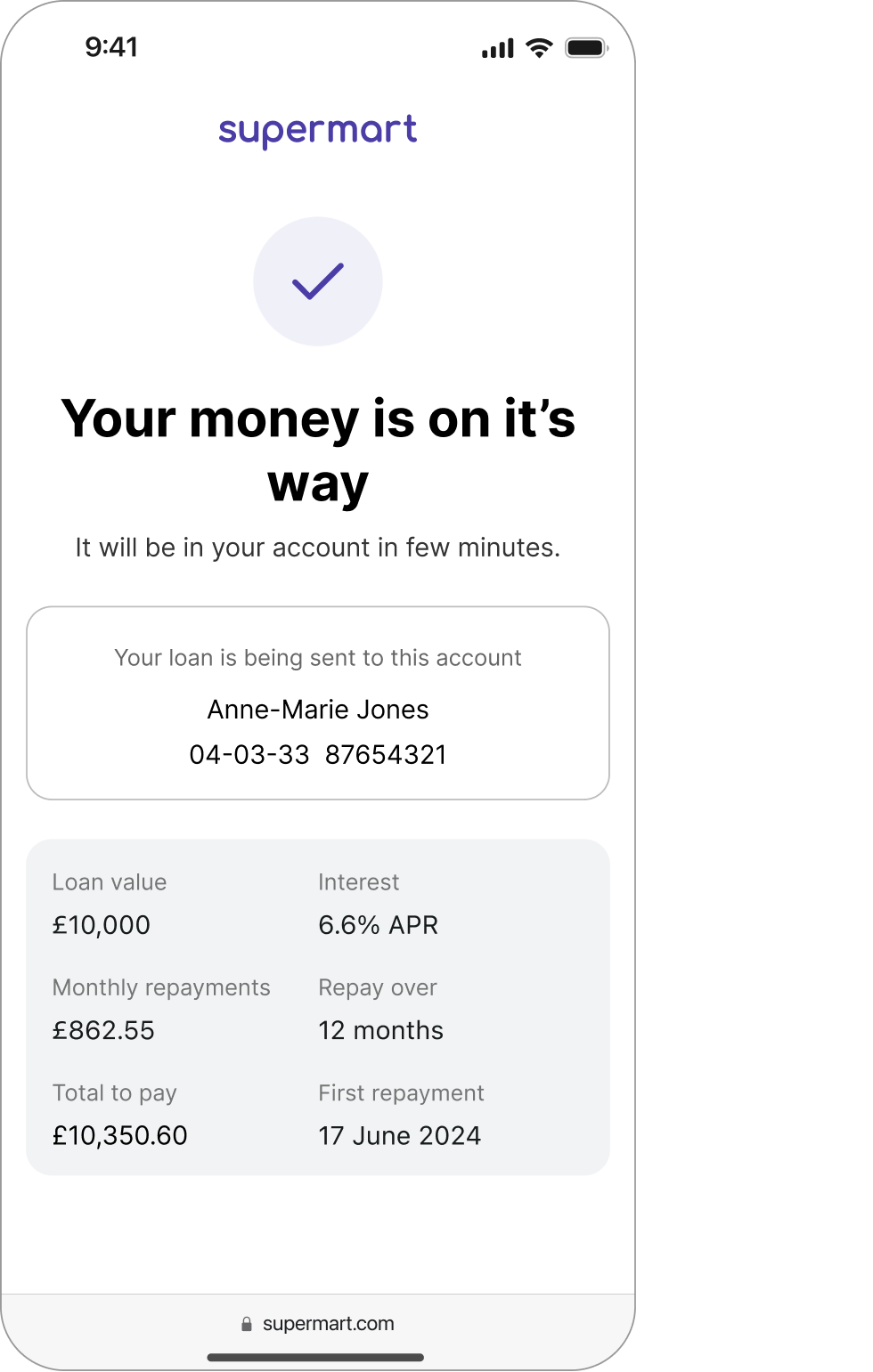

Funds disbursed

With terms accepted, loan amount is disbursed and deposited in to your customer’s bank account.

Featured use cases

Unsecured personal loans have the ability to fit into a wide range of business models and customer journeys. Here are some examples:

Home goods & DIY

Many purchases are part of larger, life changing home improvement projects. Personal loans can enable customers to afford high-ticket purchases sooner and make decisions more confidently.

Insurance

Insurance firms can expand their existing financial services offerings by offering personal loans to both new and existing customers to cover unexpected events.

Grocery

Offering personal loans gives grocery brands the opportunity to provide new offerings and services through easy access to financial services to their everyday customers.

Why Boxed for Personal Loans?

Trusted

Powered by the balance sheet of NatWest, we support your growth ambitions. Combining our leading approval rates, proven credit risk and regulatory expertise, we offer everything you need to lend responsibly.

Fast

Our white-label solution enables you to go to market faster with your brand at the forefront. If you’re looking for something more tailored, we also offer an API solution that can be customised.

Complete

Our full-service provision extends into compliance, operational and logistical fulfilment for your customers, for complete control over the quality of experience.

Future flexibility

Configure our solution to different customer segments, data and channels, enabling you to tailor and evolve your offering as you grow.

Extended capabilities

Our Personal Loans solution integrates with the extended capabilities of Boxed and NatWest to provide a complete end-to-end service.

Customer Onboarding

Identity & Authentication

Customer Service & Support

Credit Decisioning

Credit Management & Collections

Data & Insight

Get started today

Let’s discuss how Unsecured Personal Loans can generate a new revenue stream for your business.