Quick and easy lending, when your customers need it

Point-of-Sale Lending allows you to make loans available to your customers at the moment of purchase. Offer instant decisions on low value items, enable zero interest for rapid re-payment and provide short term loans quickly.

Remove friction from the purchase process to improve your brand experience, increase conversion and open new revenue opportunities.

Business benefits

Increase conversion by offering flexible payment options

Strengthen customer loyalty through a better customer experience

Grow average transaction value by making your products and services more accessible

Create new revenue streams

Increase data insight by retaining your customer and transaction data

Customer benefits

Easy-to-use

Enjoy frictionless purchase journeys

Rapid approvals

Avoid clunky loan approval processes

More choice

Choose the best payment options and lowest terms

Featured use cases

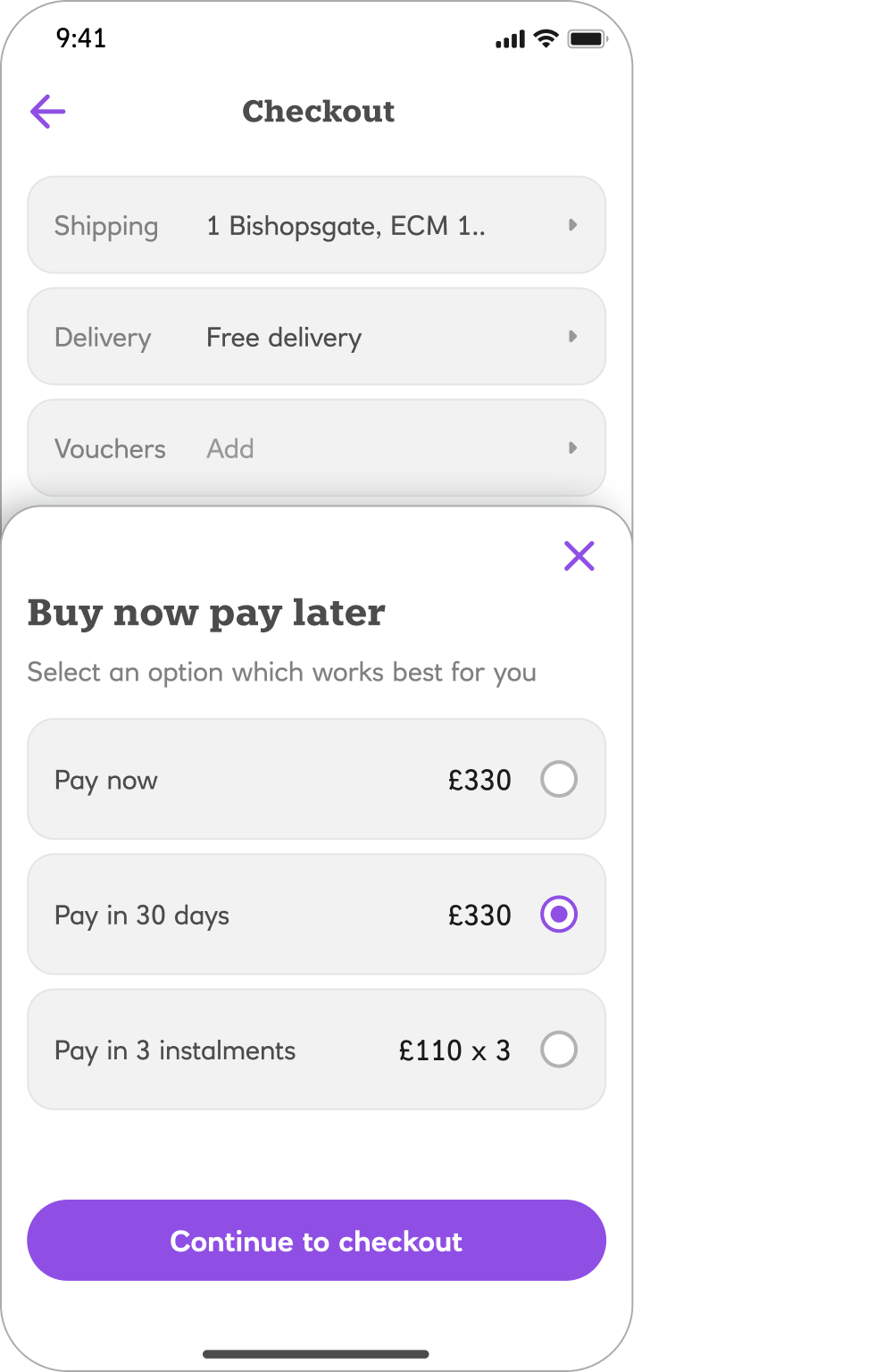

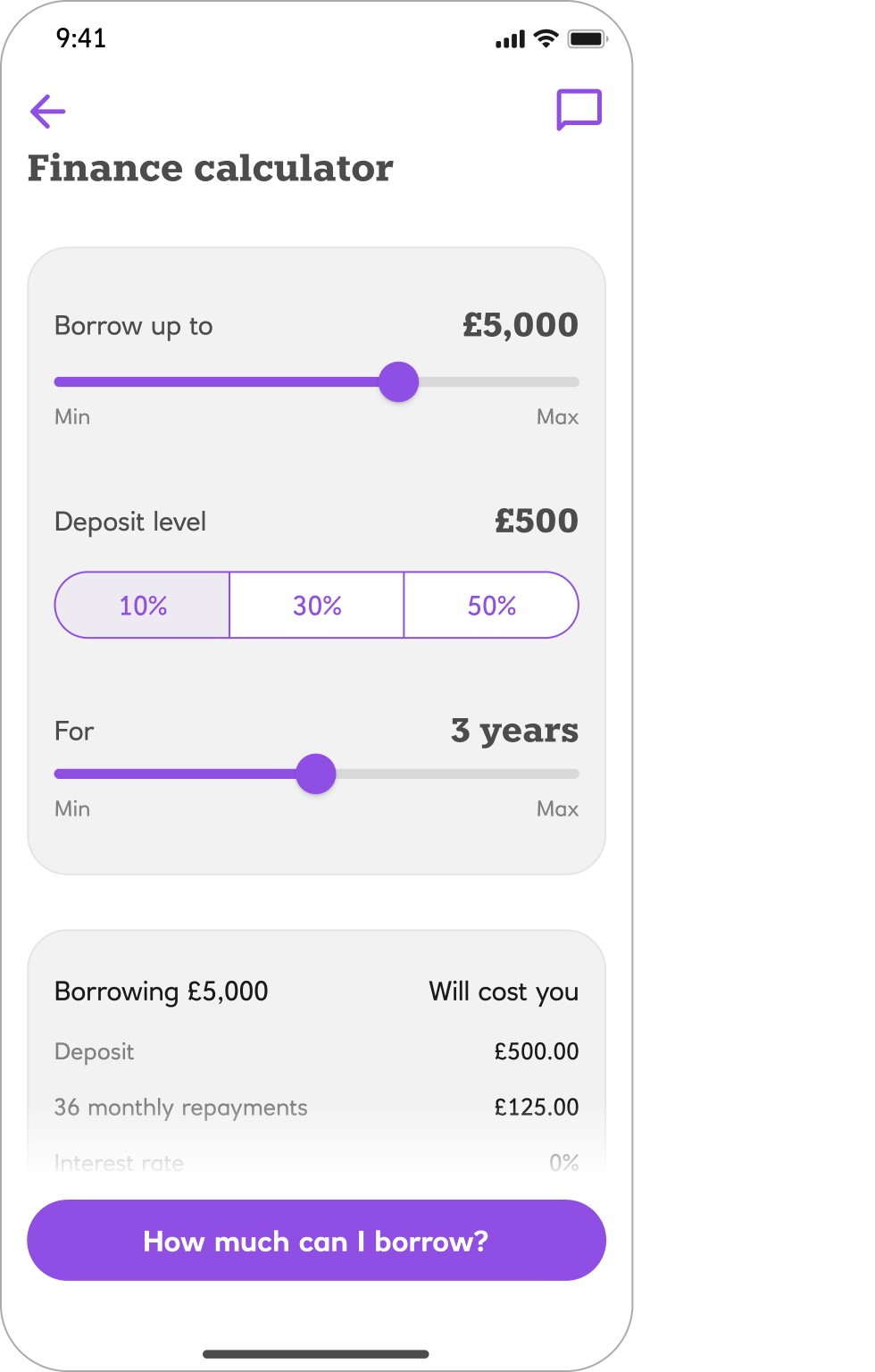

Checkout finance

Offer your customers Buy Now Pay Later (BNPL) and other lending products to make instant purchases at the point of sale. Use own brand BNPL to retain your customer relationships and avoid third party providers.

Features:

Quick and easy application for instant decisions on low value items

Optionally, terms can be made interest free for low value items and rapid repayment

Alternatively, provide short term loans for higher value items

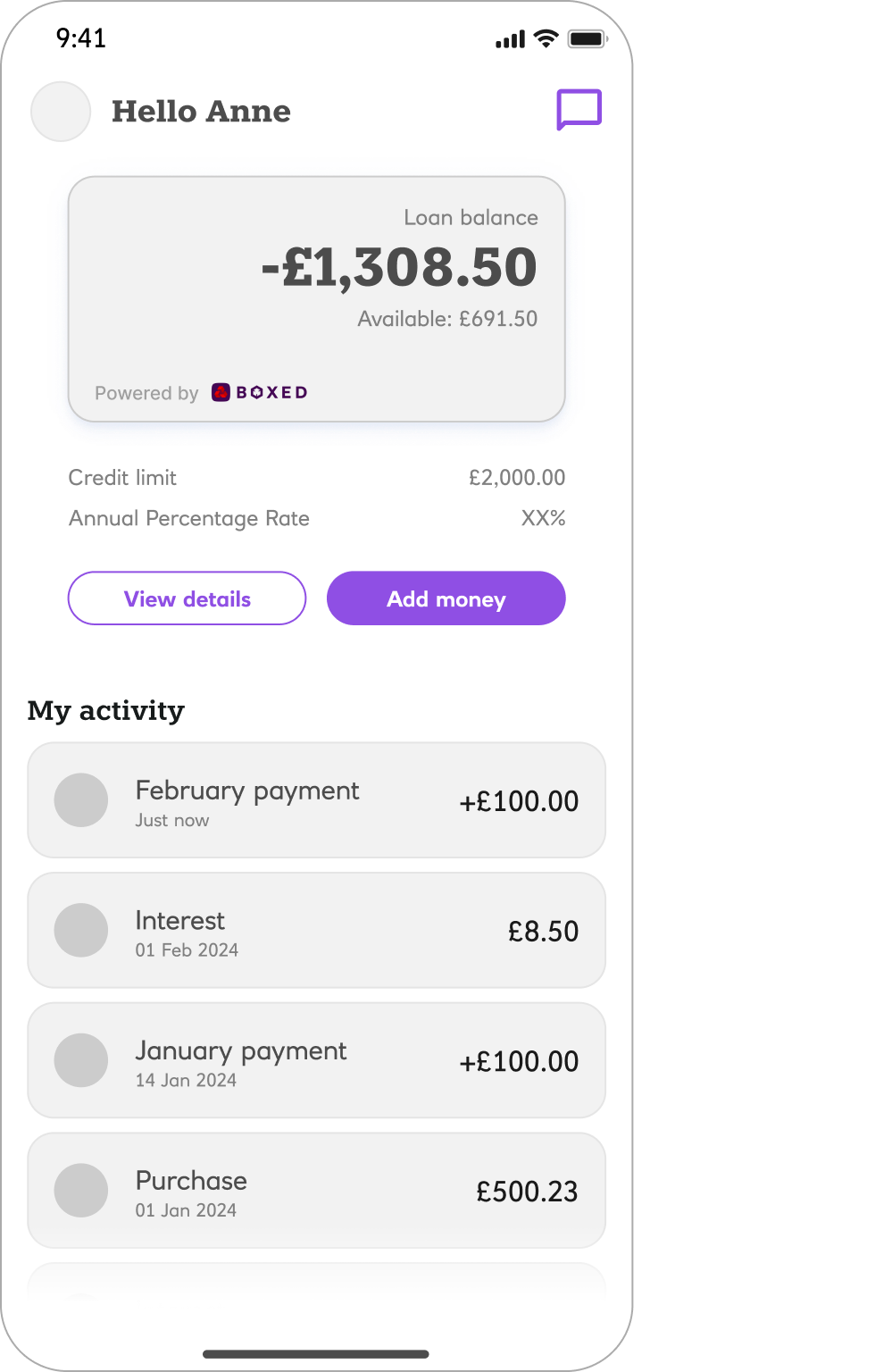

Credit

Offer always on lending facilities using open credit lines. Help your customers handle unexpected transactions or cope with emergency purchases by providing open credit balances for customers to draw down against.

Features:

Complete credit check and approval processes in advance of the moment of need

Offer choices of flexible repayment options

Provide customers with buffer spending options for unexpected needs

Elevate your checkout experience

Choose Buy Now Pay Later

Configurable repayment options to choose from

Payment account with instalments

Spread the cost of purchases

Interest-free credit

Spread the cost without paying any interest

Embedded capabilities

Our POS Lending solution features core components of Boxed banking capabilities which can be configured to achieve your vision.

Credit Account

Payments

Interest

Cards (optional)

Extended capabilities

Our POS Lending solution integrates with the extended capabilities of Boxed and NatWest to provide a complete end-to-end service.

Customer Onboarding

Customer Service & Support

Identity & Authentication

Credit Decisioning

Credit Management & Collections

Data & Insight

Find out more about POS Lending

Let’s discuss how we can help you boost sales at checkout