Article

Driving loyalty with Save Now, Buy Later

14 October 20245 minute read

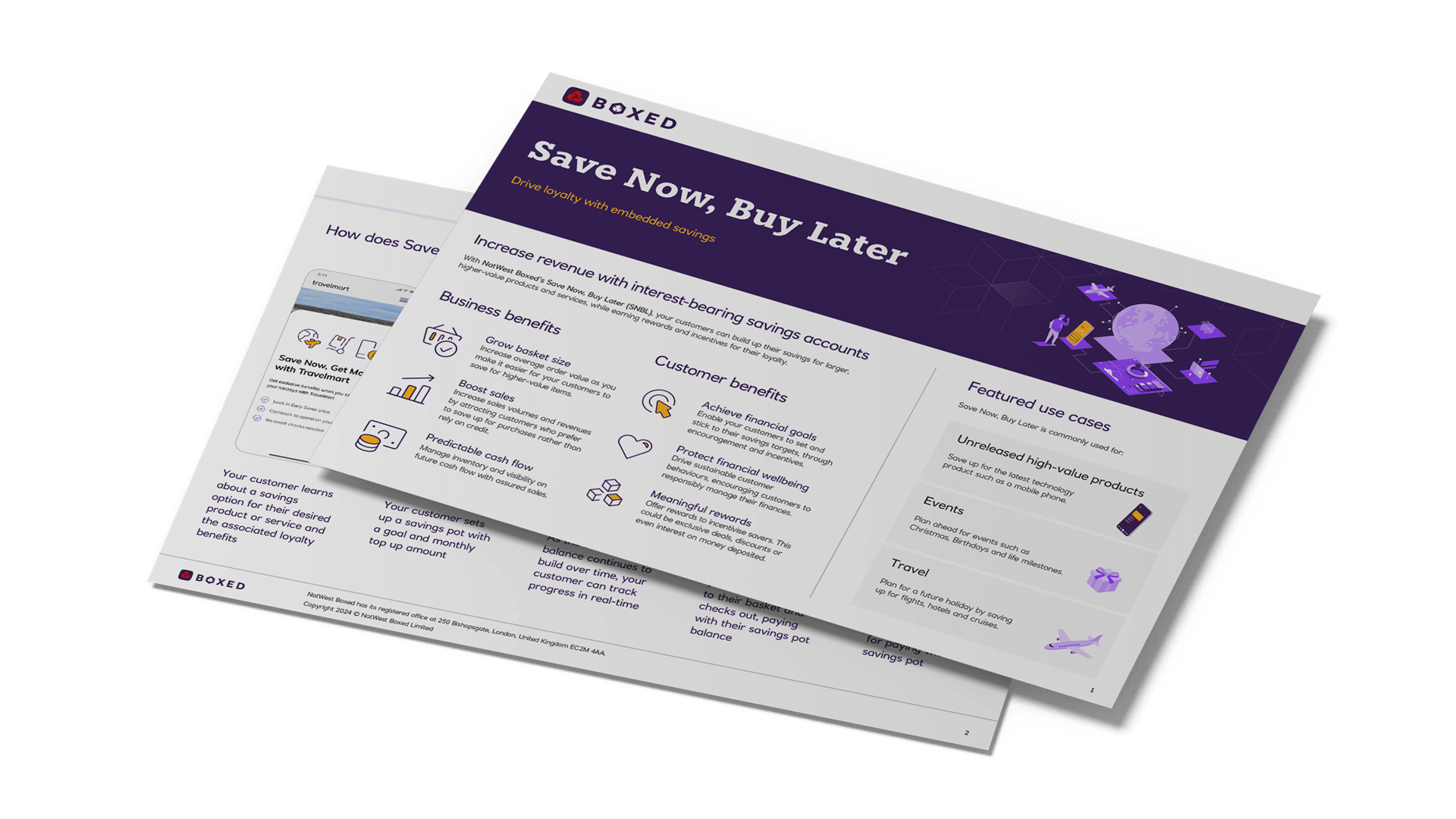

Learn what Save Now, Buy Later is, what the benefits are and how it works

What is Save Now, Buy Later?

The concept of "Save Now, Buy Later" (SNBL) is becoming increasingly popular with customers seeking to buy high-value items. The model encourages customers to set a savings goal for a future purchase and save money over time before completing the payment. This in turn promotes responsible spending habits by helping individuals avoid debt and interest payments associated with credit or other ‘pay later’ financing options. As customers save money, consumer-brands can offer discounts, rewards and other incentives to encourage their customers to save and keep them on track.

There will of course be times when people need to purchase an item immediately. If an essential household item, such as a washing machine, has broken down, most households will seek to replace that immediately and may consider Buy Now Pay Later (BNPL). But for other less essential electronic items, such as the latest high-spec virtual reality headset, customers could opt to save up for that item over several months until they have the money available to buy it outright. The best payment model will depend on individual circumstances, the nature of the item being purchased and the associated cost.

Recognising the opportunity, a number of consumer-brands are already offering SNBL options – and including incentives, such as a percentage saving off the final price, to those that open an account, reach their savings goal and complete the purchase.

Research conducted by NatWest Boxed shows that, in many cases, for items worth less than £1,000, individuals will use existing funds, a credit card or ‘pay later’ option. But for items worth more than this amount, the option to sign up to a savings plan becomes increasingly attractive. SNBL works particularly well for items and experiences that customers can save for in advance, including:

High-spec electronic devices

Travel and holidays

Tickets to premium events or experiences

Occasions such as Christmas, birthdays and life milestones

Benefits of SNBL for customers

Compared to BNPL, SNBL aligns with a more responsible and sustainable approach to spending. It emphasises the importance of budgeting and planning for major purchases without relying on borrowed money. Unlike BNPL, customers don’t need to worry about getting into debt or incurring interest charges if they miss instalments or need to extend the payment period.

SNBL allows customers to build up their savings for larger, higher-value products and services, while also giving them the potential to earn meaningful rewards and incentives for their loyalty.

Benefits of SNBL for consumer-brands

SNBL can help brands foster longer-term relationships with their customers by providing more opportunities to engage with them as they save towards their purchase.

Key benefits include the ability to:

Build brand loyalty and drive repeat business: Make personalised offers, provide rewards and promote complementary products

Grow basket size: Increase average order value by encouraging and incentivising customers to save for higher-value items over time

Boost sales: Differentiate from competitors who may only offer BNPL by attracting customers who prefer to save rather than rely on debt

Achieve more predictable cash flow: Gain better insights into future sales as customers commit to saving towards a specific product, allowing for more improved cash flow forecasting.

How can NatWest Boxed help?

Overall, SNBL helps consumer-brands build a strong, longer-lasting relationship with their customers while providing an innovative and ethical model that focuses on savings. What’s more, working with a trusted embedded finance provider like NatWest Boxed, makes it easy to seamlessly integrate the offering into the customer journey, both securely and at scale. Another advantage of being powered by NatWest Boxed, rather than a non-bank provider, is the ability to earn interest on deposits, creating a new revenue stream for consumer-brands.

Find out more about NatWest Boxed’s Save Now, Buy Later here or get in touch with our team to start the conversation today.

Related

Solution content

Introduction to NatWest Boxed's Save Now, Buy Later

With NatWest Boxed's Save Now, Buy Later, your customers can build up their savings for larger, higher-value products and services, while earning rewards and incentives for their loyalty.

Video

FT Live: Driving loyalty and revenue growth with embedded finance

Our CEO, Andrew Ellis, joined Milan Nandha, Head of Innovation at Virgin Media O2, at the FT Future of Retail Summit to discuss the power of embedded finance.